Our Unbalanced Fall Real Estate Market

Published: November 9, 2016After a wild summer the fall real estate market felt almost sluggish in the Okanagan/Shuswap, but compared to October last year sales in the North Okanagan were still higher. Our Shuswap region saw a slight decrease.

These past 12 months have been a roller coaster ride with major changes to the Canadian financial and real estate industries. Here’s a quick overview:

- June 2016 – EQUIFAX changes its credit scoring rules to evaluate borrowers ‘credit utilization’. The goal of the new system is to accurately reflect modern lifestyles and predict the probability of new credit accounts going ‘bad’.

- August 2, 2016 – B.C. government rolls out the new 15% Property Transfer Tax (PTT) which applies to any home purchased in Metro Vancouver by a foreign buyer.

- October 14, 2016 – News reports indicate Canada Mortgage and Housing Corporation (CMHC) would soon issue its first ever ‘Red’ rating for the housing market. CHMC considers four factors when deciding if a housing market is problematic: overheating demand, accelerating home prices, overvaluation compared to population and income, and overbuilding. Also, CMHC reports Canadian households are holding more debt than ever – making them vulnerable to interest rates if they rise as expected. CHMC further reports that the problem of rising household debt isn’t isolated to younger households, the debt burden is also growing for older households (ages 55+ and 65+), many of whom will carry debt into retirement!

- October 17, 2016 – Canada’s Finance Minister announces tougher qualifying rules for insured mortgages. Buyers with less than 20% down payment are no longer eligible to qualify at the fully discounted rate, they must qualify at the Bank of Canada 5-Year rate, and consequently can borrow substantially less money.

- November 1, 2016 – Toronto Dominion Bank became the first major lender to hike its mortgage rates after Ottawa’s move last month to change some of the rules that govern insured mortgages. It’s unusual for banks to move their rate out of sync with the Bank of Canada. It’s also rare for the big banks to leave a gap between their prime lending rates. We can assume other lenders will follow, but none of them are talking yet.

Hold on to your hats! We’re not done yet! Only 6 more days to the U.S. presidential election on November 8. The media coverage has reached us here too with 15 months of official campaigning, reality-show style drama and uncertainty. The outcome of the U.S. election and activity in the days that follow will have a huge impact on the global economy and interest rates. It will be interesting to see what December holds for us all!

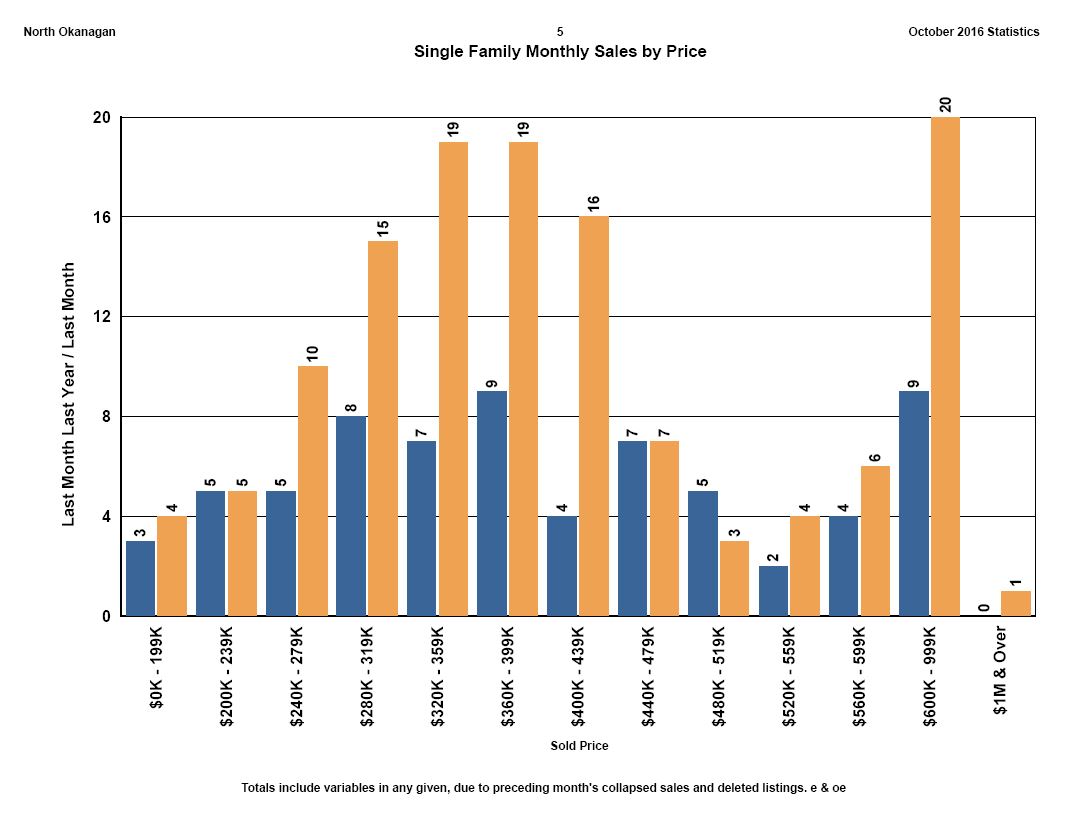

North Okanagan Real Estate Market (Vernon, Coldstream, Armstrong & Areas)

Stats for October 2016 Compared to October 2015

- Overall sales up 67% to 242 units.

- New listings, 242 units, up 1%.

- Active listings 1,459, down 21%.

- Average days to sell 128, up from 113 days, down 13%.

- Single Family home sales up 90% to 129 units.

- Single Family homes listed, increased 11% to 99 units.

- Average price, single family homes, $425,323 up 4% from $408,774.

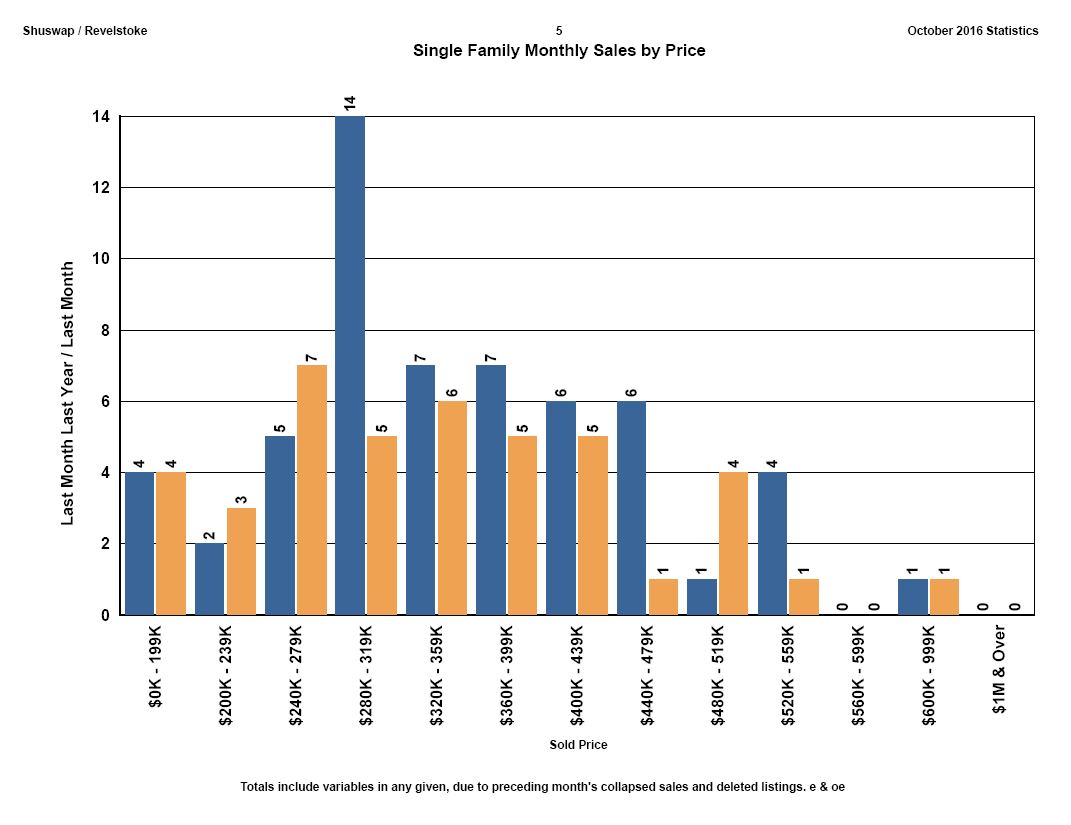

Shuswap Real Estate Market (Salmon Arm & Mabel Lake Areas)

Stats for October 2016 Compared to October 2015

- Overall sales stayed even at 111 units in both years.

- New listings, 124 units, up 3%.

- Active listings 1,056, down 18%.

- Average days to sell 168, up 16% from 141 days.

- Single Family home sales down 26% to 42 units.

- Single Family homes listed, increased 7% to 45 units.

- Average price, single family homes, $342,502 down 3% from $353,157.

Source: Okanagan Mainline Real Estate Board Statistics:

North Okanagan: North Okanagan Monthly Statistics, October 2016

Shuswap: Shuswap / Revelstoke Monthly Statistics, October 2016